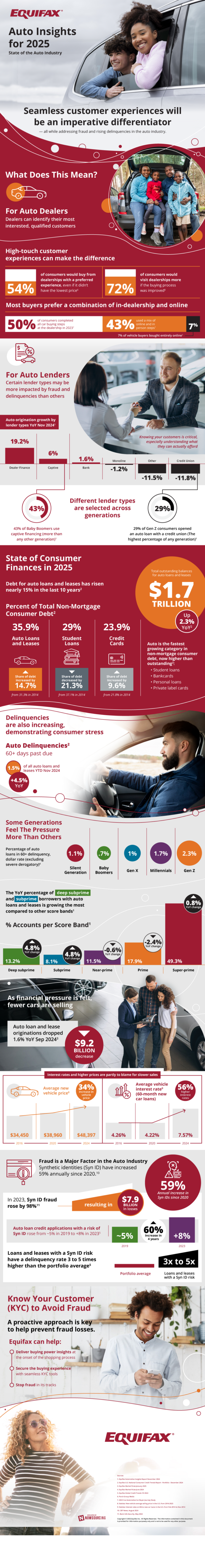

Buying things online has revolutionized many facets of modern life, and the auto industry is no different. As of November 2024, most buyers prefer to complete the car buying process with a combination of online steps and in-person completion at a physical dealership. 7% of vehicle buyers went entirely virtual and chose to purchase their vehicles entirely online.

With all these ways of buying a car, car buying has seen surging popularity. However, the other side of the surging popularity is the corresponding increase in auto delinquencies. Auto delinquencies are considered any auto loan or lease that has a payment overdue for 60 days or longer. As of November 2024, 1.5% of all financing agreements are considered delinquent. This marks a 4.5% year over year increase from November 2023.

Moreover, auto delinquency is not distributed equally. Older generations, such as Baby Boomers and Generation X, have the smallest auto delinquency percentages in their respective generations. However, the newer car buyers and younger generations, namely Millennials and Generation Z, have the largest auto delinquency rates. This coincides with the trend of progressively lower quality loan applicants. Year over year, prime and subprime loans fell by 0.6% and 2.4% respectively. Conversely, subprime and deep subprime loans both increased by 4.8%.

However, technology also affected other aspects of the car buying process. Another unexpected change technology brought was synthetic identities, also called Syn ID’s. Fraud with these Syn ID’s rose by 98% and resulted in just under $8 billion in losses. On top of that, auto loans and leases with a Syn ID have a delinquency rate between 3 and 5 times higher than average.

Fortunately, new technology has risen to rival new technology. To combat Syn ID’s, companies like Equifax have released Know Your Customer (KYC) technology. This works by providing insights into your customers’ buying power prior to signing any paperwork. This means you can verify who you’re doing business with before doing business. Ultimately, to protect your business against Syn ID’s, it’s important to take advantage of technology from Equifax.