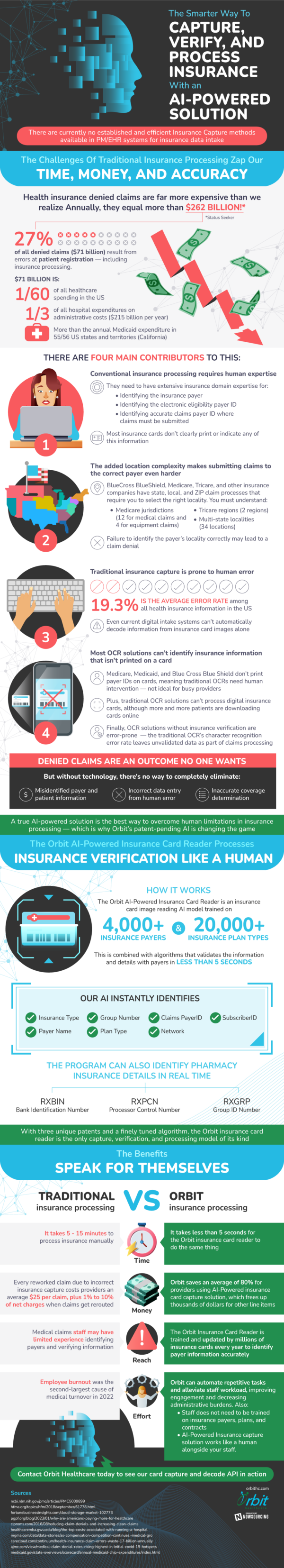

Insurance is a trillion dollar industry in the United States, fueling and aiding business and individual success for as long as most can remember. Identifying and processing insurance, however, is currently an outdated process that is in need of development. The existing challenges of traditional insurance processing steal our time, money, and accuracy, costing the industry a total of over $260 billion annually.

Many of these problems are due to the limitations of traditional insurance capture. Most of the current methods cannot identify any insurance information that is not printed on a physical card. In this digital age, more and more plan holders are downloading their cards online, eliminating the physical aspect of an insurance card altogether. In addition, some providers like Medicare, Blue Cross Blue Shield, and Medicaid do not even print payer IDs on cards, leaving busy providers in need of humans to complete the job. This need for human intervention is commonplace in the insurance industry, using professionals to pick up where technology is no longer effective. However, when humans become an integral part of the process, the chance for error increases greatly. Failure to properly identify different aspects of a plan often lead to denied claims.

In the midst of several shortcomings in the industry, there are early developments in the works on an AI-powered solution to verifying and processing health insurance card capture. This technology would have the ability to identify thousands of insurance payers along with tens of thousands of insurance plan types. The unique algorithm would greatly reduce the limitations of the industry, fixing many of the problems that currently plague insurance companies. What was once slow and inaccurate is quick and efficient, doing what was once done in minutes, in seconds. There is no denying a new way of processing is the way to go, leaving outdated methods in the past.