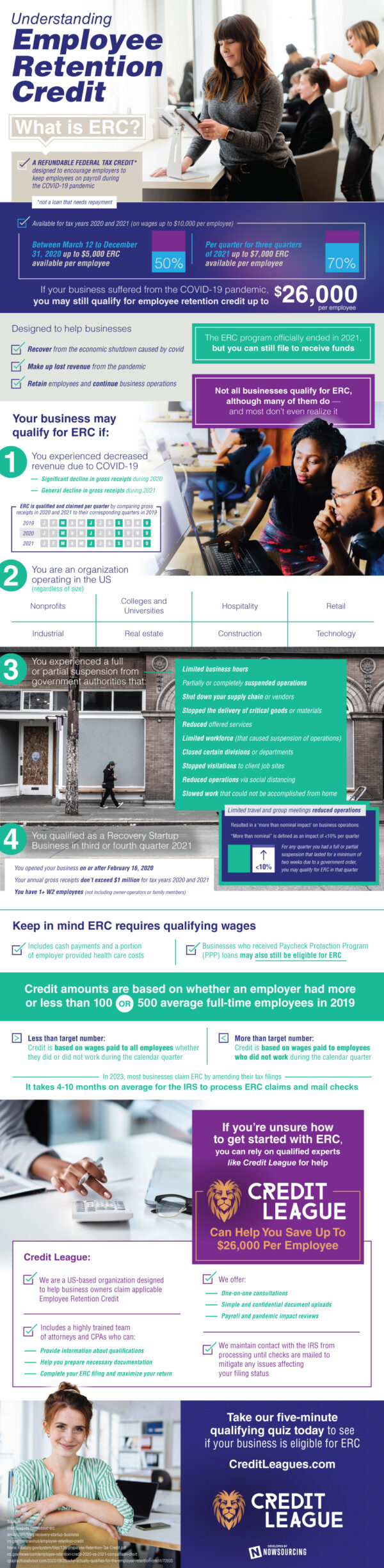

The Employee Retention Credit (ERC) is a federal tax credit introduced to incentivize employers to retain their workforce during the COVID-19 pandemic. The ERC was specifically designed to assist businesses in recovering from the economic impact of the 2020 shutdown, compensating for pandemic-related revenue losses, and enabling them to retain their employees and sustain operations. Unlike a loan, this credit does not require repayment and is available for the tax years 2020 and 2021.

In 2020, eligible employers could claim up to 50% of wages paid, capped at $10,000 per employee, between March 12 and December 31. This meant businesses could receive a maximum credit of $5,000 per employee. In 2021, the ERC was increased to 70% of wages paid, also up to $10,000 per employee per quarter, for three quarters. This provided a potential credit range of up to $7000 per employee for the year.

Numerous businesses may qualify for the ERC without realizing it. Eligibility criteria include a significant decline in gross receipts during 2020 or a general decline in gross receipts during 2021, compared to the corresponding quarters in 2019. Businesses operating in various sectors, including nonprofits, colleges and universities, or industries such as hospitality, retail, industrial, real estate, construction, and technology, may be eligible.

To claim the ERC, businesses must have incurred qualifying wages, including cash payments and a portion of employer-provided healthcare costs. Businesses can typically claim the ERC by amending their tax filings in 2023, but it may take the IRS an average of 4-10 months to process the claims and issue checks. For businesses seeking guidance with the ERC process, Credit League offers specialized assistance. They have a team of attorneys and CPAs who can provide information on eligibility, help with documentation preparation, complete the filing, and maximize the return.