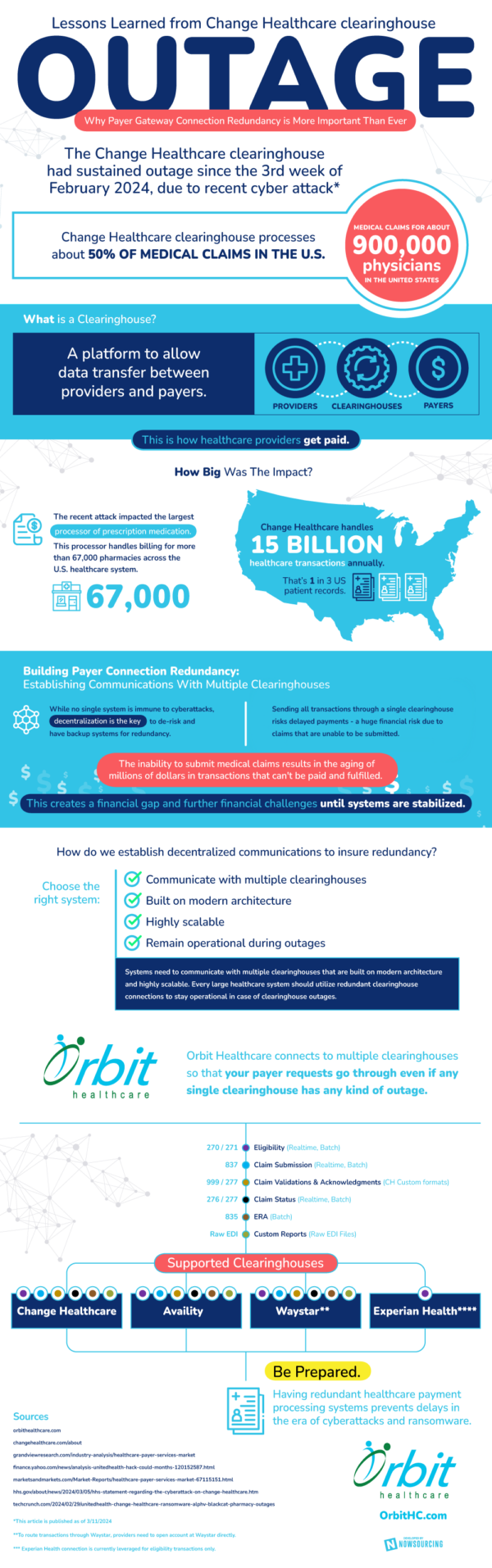

A clearinghouse is a platform that is created to allow and facilitate data transfer between providers and payers. The Change Healthcare clearinghouse is one that processes about half of the medical claims in the United States. This accounts for claims for about 900,000 physicians across the country, equaling 15 billion annual transactions, turning Change into one of the largest clearing houses in the nation. At the end of February, the Change Healthcare clearinghouse experienced outages due to a cyber attack. The impact was immense, and helped to establish a greater need for payer connection redundancy between clearinghouses.

Establishing redundancy means to create a backup plan in the case of cyber attacks. While no single system is immune to cyber attacks, decentralization can help to lower the risk of such attacks. Sending all payments through a sole clearinghouse delays operations, leading to huge financial risk and the potential for a cyberattack to be detrimental. When data is spread across several platforms, no single cyber attack can affect all of the data at once. This helps to keep things efficient and limit the aging of unfulfilled transactions.

Communication is key to establishing a redundant payer system. When multiple clearinghouses can effectively work together, everyone benefits from the speed and reliability of payment processing. Another key is remaining operational during outages. Through payer redundancy, even if the largest clearinghouse is out of commission, others will be able to remain operating to ensure that the entire system is still effective nationwide. There are several companies and programs that are aiming to help remedy these current issues of combating cyberattacks. These companies work closely with clearinghouses every step of the way. From initial communication, to claim submission and validation, to claim status, and generating reports, it takes a village to keep payment processing up and running.