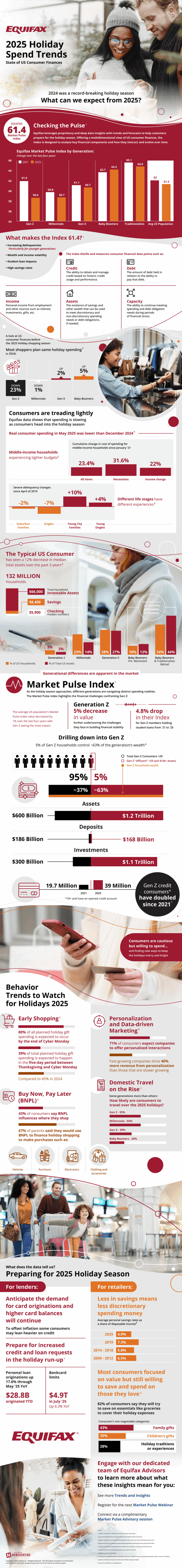

When it comes to the holiday season, having presents under the tree as a kid was a magical feeling. However, as adults, the holiday season means being the one buying the presents to create the magic. In recent years, making that magic happen has been harder and harder due to market conditions and economic stability. In fact, it is estimated that Millennials and Generation Z were in a better financial position in 2021 than they are in 2025. Consequently, it is estimated that planned holiday shopping is down 23% for Generation Z and 1% for Millennials compared to 2024. So, what business trends are coming this holiday season?

It seems like one way or another Christmas will be coming as 43% of people think family gifts are non-negotiable during the holiday season. Similarly, 35% of consumers surveyed think children’s gifts are non-negotiable. So, with low discretionary spending, what other avenues do consumers have?

One of the largest new services is Buy Now, Pay Later (BNPL). Essentially, large purchases or a large volume of purchases can be split up into monthly payments to make it more affordable. Almost half of all consumers say that having a BNPL option influences where they shop and 67% of parents are already planning to use BNPL this holiday season. Another strategy is by planning when to shop. It is estimated that 80% of all holiday gift spending will be done by the time Cyber Monday ends. 40% of this total will be in the 5-day gap between Thanksgiving and Cyber Monday.

For these reasons, it’s so important for businesses to maximize their consumer engagement. In fact, 71% of consumers expect companies to offer personalized interactions when they shop. That’s why it’s so important to take advantage of these consumer insights from Equifax. With this information, your business can properly prepare itself for the holiday season, and make sure you capitalize on the shopping craze.