In the United States, a person’s credit score can carry a lot of weight when considering their future financial success. It can affect a wide variety of a person’s life outcomes, including their housing options, their interest rates, and even what type of job they can have, as some employers check credit scores as part of their background check. A low credit score has serious repercussions since it raises interest rates on loans and mortgages, which over time can result in additional expenses totaling thousands of dollars.

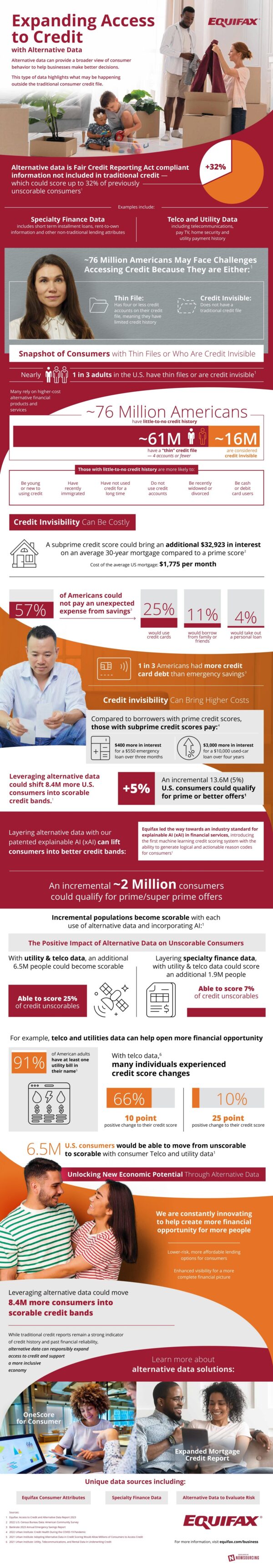

Even though it is extremely significant, 76 million people still do not have a sufficient history of credit use to qualify them for most loans. 61 million of these people have “thin files,” or less than four credit accounts, and 16 million are “credit invisible,” meaning they have no credit history at all. Young adults, immigrants, recent widows or divorcees, and those who utilize cash represent the majority of people that are affected by these concerns, which puts them at a financial disadvantage.

As lenders begin to realize that they are alienating a large portion of their potential customers, they are beginning to take a more inclusive approach. One method is to consider alternative data as part of evaluating someone’s trustworthiness to pay back loans. Alternative data is considered anything to be outside of a traditional credit report that is still considered Fair Credit Reporting Act Compliant. This includes payments made for utilities and telecommunications, as that is a recurring bill that is required to be paid on time.

Using alternative data for credit scoring can help score 32% of people who were previously deemed unscorable. This means a financial lifeline can be given to millions of people who were previously shut out of the traditional credit system. It also ensures that a larger range of people can obtain the credit they require for significant purchases and crises, which can vastly improve the quality of many people’s lives.