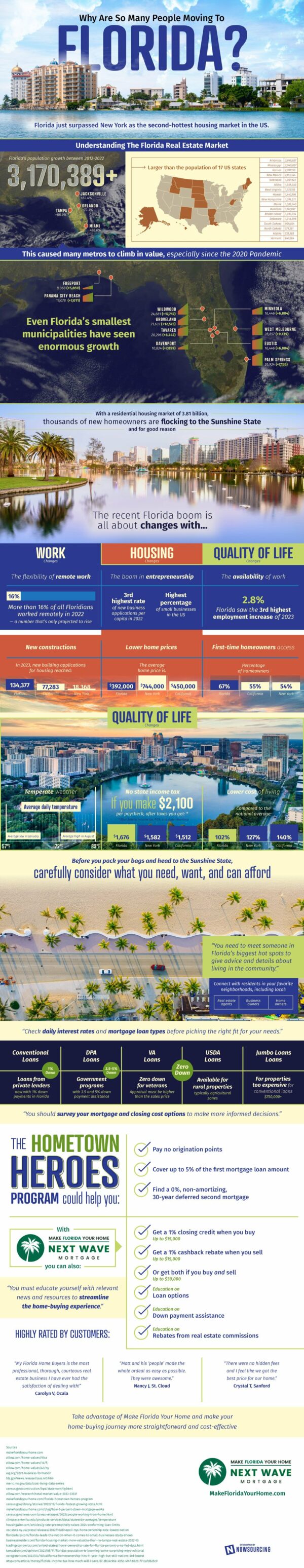

Florida has become the new hottest destination for homeowners, rising up to become the second hottest housing market in the country. But is driving many to call the ‘Sunshine State’ their home? It seems like a combination of factors ranging from lockdown factors to economic conditions. Namely, the introduction of remote work allows many to enjoy Florida’s temperate climate while also being productive in the workplace. To pair with that, there is an explosion in the number of new building applications and a high degree of accessibility for first time homeowners. Furthermore, Florida has relatively low average home prices when compared to other major cities like New York and California.

While the attractive appeal of moving to Florida is certain, the process of transitioning from tourist to homeowner is not straightforward. There are numerous loan options to choose from, tailored to different individuals based on a variety of factors. While conventional loans can have some merit, there are other types available with better perks for people with qualifying circumstances. One example is VA loans available to veterans who don’t need a downpayment for the loan. Another is a USDA loan for individuals purchasing property in a rural area or in agricultural zones. Since the landscape of Florida is as diverse as its population, the state is comprised of farmland and metropolitan areas alike. Therefore, different prospective Florida residents would find different loans are applicable to them.

With the daunting task of purchasing a home, the merit of a mortgage company shines through the most. Companies like Next Wave Mortgage inform on down payment assistance, loan options, and even rebates. In addition, they offer 1% credit on sales and purchases of sales. Ultimately, anyone looking to become a Florida resident can circumvent the tediousness and intricacies associated with homebuying by partnering with a mortgage company.